A Life insurance is a long-term plan to save money and protect your family if something bad happens to you. This policy is an agreement between you (the policyholder) and an insurance company. In exchange for your regular payments, the company promises to pay you money if you die. The payment is a tax-free lump sum that is sent directly to the people you choose as your beneficiaries. It will help them stay financially stable and reach their goals even after your gone. Get in touch with us right away to talk about your choices and get a free quote!

Plan For The next Generation

A life insurance policy tailored to safeguard your loved ones' financial security even in your absence.

Who is this policy for?

Individuals with Dependents

Your loved ones won’t have to worry about paying bills, mortgages, and living expenses since you have life insurance.

Business Owners

Covers the costs that can arise if you pass on while still contributing significantly to your company’s performance.

Individuals Seeking Investment and Savings

You can borrow against or withdraw from the cash value portion of your policy as it grows (within the policy’s terms and conditions).

The Benefits of Life Insurance

Financial Security

To ensure their financial security and peace of mind, life insurance offers a guaranteed payout.

Long Term Saving

Life insurance can help with a variety of financial matters including paying for a down payment on a house or college for your kids.

Tax Benefits

Beneficiaries are exempt from reporting payouts on their tax returns because these payments are not regarded as income.

Permanent Disability Coverage

When you’re unable to work because of an incident, permanent disability insurance helps you provide for your loved ones financially.

Critical Illness Coverage

In the event of a catastrophic sickness, like as cancer, heart disease, or stroke, this rider will pay out a lump amount.

Policy Riders

The policy can have further benefits attached to it that cover things like Permanent disability benefit, and accidental death benefit

Use the yellow hot spots and explore how individual life insurance can help protect against the common risks.

Raising a child can be a rewarding life experience, but it is also very expensive. It costs hundreds of thousands of dollars to raise a child to age 18, with college tuition, fees, room, and board resulting in another potentially enormous expense. If you were to die tomorrow, would funds be available to provide for food, clothing, day care, and educational expenses for your child?

Having life insurance could secure the future for your children if you have an untimely death. With a life insurance policy, there could be enough income to help pay for everything your child might need while growing up.

After your death, any outstanding debt and financial obligations do not disappear. Your home is probably the costliest and most significant property you own. A mortgage payment is a large burden for a spouse or partner to carry.

A life insurance policy would allow your spouse or children to pay off your outstanding debts and spare them the stress of making monthly payments on the home.

Many families lease or finance their automobiles these days. If the primary earner in the family were to die, the family could be left with outstanding car payments for years to come.

A life insurance policy would allow your spouse or children to pay off your outstanding debts and spare them the stress of making monthly payments on your car(s).

An average funeral can cost tens of thousands of dollars, and that's without unnecessary options or luxurious services. A death in the family is stressful enough; why add the hefty bill of a funeral to that stress?

A life insurance policy can easily cover the cost of a funeral. Your family will be able to think of you and have peace of mind without being burdened by funeral costs.

Once you retire, you will be living off social security, and if you are lucky to have them, a pension or retirement fund, too. But what if the surviving spouse has been relying on you to fund retirement for the couple? Premature death of an earner can affect sources of retirement benefits such as Social Security.

Life insurance can help support a surviving spouse during their retirement.

If you passed away, would your business suffer? There are many complications and financial issues that can arise due to the death of a business owner. Many people overlook this predicament.

A life insurance policy can keep a business moving along even during tough times, such as the loss of the business owner/partner. Key person life insurance is payable to the company and provides money for training and hiring of a new employee. A buy-sell agreement, funded by life insurance, allows the other partners in the business to buy the deceased’s share of the business, which will provide money for his or her family.

Many people mistakenly think that they don’t need life insurance if they don’t have children or if their children are grown. However, your financial responsibilities fall to your family when you are gone.

Life insurance can replace the income you would usually bring in and help support your spouse or adult children, ensuring your loved ones are able to maintain the lifestyle they're accustomed to.

How Do You Decide On A Life Insurance Policy?

With so many alternatives out there, it can be difficult to choose the best life insurance policy, despite the fact that it provides invaluable security for your loved ones. To get started, it is important to understand what your objective is and how it aligns to the available options in the industry. Let’s have a look at the options available for a life insurance policy.

Term Life Insurance Cover:

The primary goal is to provide reasonably priced health insurance for a set duration, usually 10, 20, or 30 years.

Whole Life Insurance Cover:

It covers your whole life with a sure death benefit and a cash value part.

Endowment Insurance:

Combines protection and savings, offering a guaranteed payout at the end of the policy term (maturity) or upon death, whichever comes first.

Unit-Linked Life Insurance:

Combines life insurance coverage with investment potential where a portion of premiums are invested in units of a chosen fund, offering the potential for higher returns but also carrying investment risk.

Cost Premiums and Eligibility For Life Insurance

How much does life insurance cost?

Getting a life insurance coverage will depend on several factors specific to you and your coverage choices like your age, health, and the coverage amount that you would wish to be given to your beneficiaries when you are gone.

How Can You Afford Your Life Insurance Policy?

We will work with you to determine the most convenient method of paying premiums for the life insurance policy you select; these payments are due monthly. As an example, whole life insurance, which builds cash value over time, typically has higher rates than term life insurance, which typically has lower premiums. Furthermore, rates tend to go up when policies provide riders with extra advantages.

Who Can Get Life Insurance?

You can buy life insurance as long as you are at least 18 years old and not yet 65 years old, which is the average retirement age.

Financial Matters To Consider Around Life Insurance

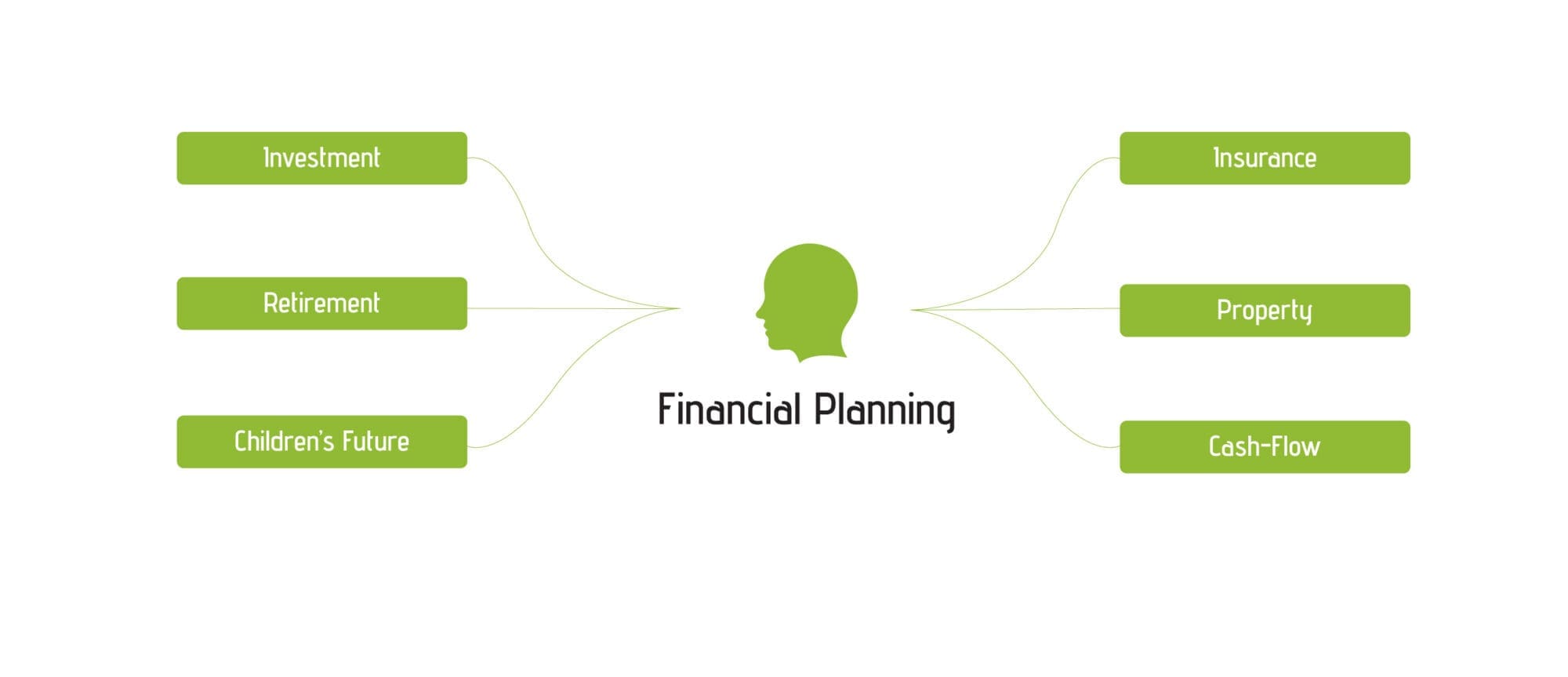

Life insurance is a crucial pillar in a secure financial future, but it’s just one piece of the puzzle. Here are 6 key areas of financial planning that every Kenyan citizen should consider

1. Investment

Read our blog to take advantage of investing possibilities like mutual funds, stocks, and bonds to build your wealth and accomplish your long-term objectives.

2. Insurance

Protect yourself and your belongings from financial emergencies with several insurance policies. Examples include life, health, property, and auto insurance.

3. Property Acquisition

Consider location, money, and finance when buying your property. A Home-Owner insurance policy can protect your property’s valuables.

4. Retirement Planning

To get the most out of your retirement savings, look into other possibilities, such as making individual contributions to private pension systems.

5. Your Children's Future

Think about looking into life insurance policies that have an education policy rider tailored to cover education benefits for your children. An alternative is to look into educational savings plans.

6. Cash Flow Management

Stick to a budget to save money and regulate your expenditures. This includes saving for your goals and managing debt.

Let’s discuss your individual life insurance.

One of our insurance advisors will reach out to you to review your information and present you with the appropriate individual life insurance solution. There’s no obligation, just good-old-fashioned advice.

Dawit Insurance Agency offers comprehensive individual life insurance in Nairobi, Kenya and surrounding areas.

Frequently Asked Questions About Life Insurance

- What is life insurance and how does it work?

- What are the 4 main types of Life Insurance?

- How much money do you receive from life insurance?

- For how many years do you pay Life Insurance?

- Can you cash out Term Life Insurance?

- How do I withdraw money from my Life Insurance policy?

Life insurance is a financial contract between you and an insurance company. In exchange for paying regular premiums throughout your life (or a set period), the insurance company guarantees to pay a death benefit to your designated beneficiaries upon your death.

The 4 most common types of Life Insurance are Term Life Insurance, Whole Life Insurance (Permanent Life Insurance), Endowment Life Insurance and Unit-linked Life Insurance.

The lump sum payout for a life insurance policy is usually decided by the policy’s face value, which is a predetermined amount stipulated in the policy contract.

The duration of payment depends on the specific policy you choose. For example; a Term life policy is set to a number of years. This could be 10, 20, 30 years (depending on what you choose).

A Permanent Life Insurance policy on the other hand is subject to payment for as long as you (the policyholder) are alive.

No, Term Life insurance does not accumulate any cash value hence providing nothing to be cashed out.

- Know what your policy says:

Carefully read your policy papers to fully understand the specific rules for cash value withdrawals and any fees or charges that come with them. Some of these are surrender fees, minimum exit limits, and tax effects.

- Get in touch with your insurance company:

Call the customer service line for your insurance company or your assigned agent.

Tell your insurance company that you want to take money out of the cash value of your policy.

- Get the papers you need:

The insurance company may need certain papers to handle your request. Some of these are:

- Proof of who you are: Your passport or ID card.

- Policies: Either the original policy or a copy that has been signed by a lawyer.

- Withdrawal Form: For example, the insurance company may give you a form to fill out and send in.

- Finish the process of withdrawing:

Follow the steps that your insurance company gives you for the exit process. This could mean sending them the filled-out forms and papers along with any other information they need.

The insurance company will look over your request and figure out if there are any fees or charges that need to be paid. After taking these things into account, they will let you know the final payment amount.

Once you are approved, the insurance company will send you the approved withdrawal amount. Depending on what you choose, this could be through a bank transfer, check, or direct payment.