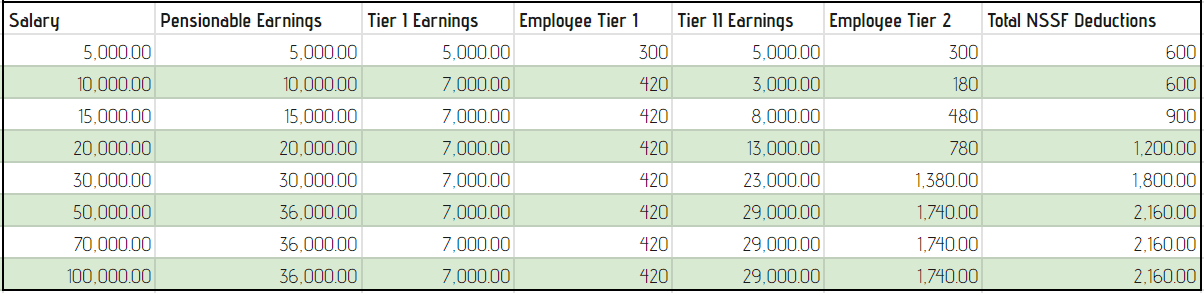

Moving your Tier 2 NSSF contributions to a private pension increases the value of your social security returns. Here’s why:

- Higher Potential Returns: Get a wider range of investment options compared to NSSF, potentially leading to higher returns. Your retirement cash value grows faster, giving you the freedom you deserve in your golden years.

- More Control over investment: Gain greater control over your investments with a private pension. We offer you a fund that aligns with your risk appetite and retirement goals, whether it’s steady growth or maximizing potential returns.

- Additional Benefits: Go beyond just saving for retirement and enjoy additional benefits like investment management advice.