Group Life Insurance or Assurance is an annual cover that provides compensation to the deceased’s beneficiaries in the unfortunate event that the assured dies while in the service of the employer. This is a benefit given by the employer to his employees, and it is the employer who pays for the premiums. The rule of thumb is that the benefits are calculated based on the member’s annual salary, age, and gender, and the sum assured is paid to the dependents.

Group Life Insurance

Group Life Insurance (aka Life Assurance) plans for a business or group of any size

Who is this product for?

Paying for life insurance for employees is a valuable benefit that can be a big selling point when recruiting staff.

Our group life cover options cater for large corporates (with thousands of employees), SMEs, micro SMEs (with a minimum of 3 employees), registered family groups and even chamas and other groups.

Depending on the plan, your business can cover employees only or offer coverage to the family.

By pooling the risk in a group life cover, the employees’ medical history and pre-existing conditions may not matter in pricing or risk acceptance by the underwriters. The cost per employee is usually much less than the average amount they’d pay if each staff bought insurance individually.

Ready to offer your employee’s group life insurance? We can help you weigh your options—request for a quote today by filling on the form at the bottom of this page.

Why take Group Life Assurance Cover?

The aim of this cover is to assist families at their most vulnerable point. It also gives peace of mind to both the members, as well as the employee and employer. This cover also helps attract and retain quality staff as it forms one of the welfare benefits.

- Employee incentive – Employees are motivated when they can feel the reciprocity and trust of the employer. The Group life cover enhances the feeling of reciprocity and, in turn, gives the staff reason to go the extra mile in achieving organizational goals.

- Employee retention – Since the group life cover is an over and above employment benefit, some employers do not offer it. As a result, staff retention is enhanced as employees do not want to lose this benefit upon changing employment.

- Employee Attraction – Employers with generous benefits such as Group Life Assurance and medical insurance tend to attract better quality and quantity of talent

Insurance Premium Financing (IPF)

Did you know you can pay insurance in several instalments? Insurance premium financing helps you get a cover when you need it and allows you to pay for the cover in several instalments. Talk to or fill the form at the bottom of the page to learn more.

What challenge will it solve?

Life and accidental death and dismemberment insurance is designed to pay out to the employee’s financial dependents to make up some of the lost income if the employee dies. Depending on the policy, the coverage could last for a limited period, until the employee reaches retirement age or until they die regardless of when that is.

Accidental death and dismemberment insurance is a variation on life insurance, but it only pays out if the death is from an accident (or in some cases a homicide). It usually only pays out if the death happens while premiums are still being paid (similar to term life insurance).

The plan pays out a smaller amount if the covered person loses their sight, a limb, toe or finger in an accident. Accidental death and dismemberment insurance can be a policy on its own, or it can be added on top of the normal life insurance payout.

What’s Covered Under Group Life Assurance?

The main cover is the death benefit, also known as death in service. It pays for death from any cause except that which is expressly excluded as per your policy. The following are the benefits to this cover.

Death

Death while in service is the main benefit covered under this policy.

Permanent Total Disability

This is a condition in which an individual is no longer able to work due to injuries.

Critical Illness Cover

Upon first-time diagnosis of certain conditions, a lump sum will be paid to the life assured/staff member.

Funeral Expenses

this caters to the funeral expenses of a member in the event of their demise. Payable within 48 hours after notification and complete documentation.

Other niche benefits include; Income Replacement, Retrenchment and retirement extension, Spouse and Children Funeral expenses benefit, Parent and parents-in-law Funeral expenses benefit, and so on.

Show Your Employees That You Care With Group Life

How can you show your employees that you care about them with group life insurance?

Show Empathy

This is a good way of showing emotional support.

Supporting Family

Create a financial cushion in case of death or disability. It shows families you care at their most vulnerable moment.

Employee Satisfaction

Offer your employees the peace of mind they need while working with you

Why work with us?

Did you know that working with an insurance agent doesn't cost you anything extra? You also get advisory services when choosing covers and we walk with you during claims.

Key considerations for life insurance

What are the factors we'll consider when choosing the best medical insurance cover for your business or group?

Budget

We consider your budget. However, Insurance Premium Financing (IPF) can allow you to pay in installments giving you more flexibility with your budget.

Product Fit

We consider the appropriate product that maximizes your coverage. The advantage of working with an insurance agent is we give you several options to choose from while leveraging our partnerships with various Insurance companies.

Limits

We also consider limits and sub-limits for different conditions. Conditions such as HIV, diabetes, asthma, and even cancer differ in limits from provider to provider. We’ll help you choose something that works for your people.

Restrictions

We consider restrictions on pre-existing conditions. Some providers put a waiting period and exclusions when joining a cover with pre-existing conditions. We’ll help you choose something that works for you.

Deductibles

We consider copay and any other deductibles. Copay means that the insured and the employer cost-share the cost of insurance. Depending on your desires, this can be applied only for some conditions or for the entire cover.

Service

We believe in practicing insurance with differentiated customer service. When helping you choose a cover, we only consider insurance providers known for quality and excellent customer experience.

Options for funding life insurance

Full employer sponsorship – Employers can cover the premiums in full.

Split costs between employer & employee – Employers can split the cost with employees.

Insurance Premium Financing (IPF) – This option involves a financier (bank) paying insurance premium in full to the insurance company and the insured pays the financier in instalments inclusive of interest.

Benefits of Insurance Premium Financing

Insurance Premium Financing is a facility that enables you to pay your annual premiums in monthly instalments instead of one large lump sum payment. We have partnered with a bank to facilitate this for our clients and enjoy the following features;

- Flexible financing terms of up to 6 months, and all other covers up to 10 months

- Very low-Interest rates linked to base rate and charged on a reducing balance

- Easy application process.

- Quick processing time.

How much would it cost you?

The costs associated with group life insurance varies depending on your business, how many employees you have, and how old the employees are. Share with us a full list of employees with their ages and job titles for us to compute the actual cost. Also include the company name and industry in your submission.

More Employee Incentives

Group Personal Accident Insurance

This policy covers your employees for accidental death and total disability, replacement of lost accident income during a temporary disability, medical expenses for 365 days a year, worldwide including as fare-paying passengers on any licensed form of public transport, including commercial aircraft.

The Dawit Touch

Here is what we'll happen when you purchase our employee benefits

At Dawit Insurance Agency we go above and beyond to help ease your work. We’ll help you prepare an employee benefits handbook that can guide new and current employees on all available benefits.

We can also conduct training for existing employees to educate them of available benefits with your new purchase. All the value adds we do come to you at no extra cost.

Being there for you

We help you get your claims settled speadily and fairly

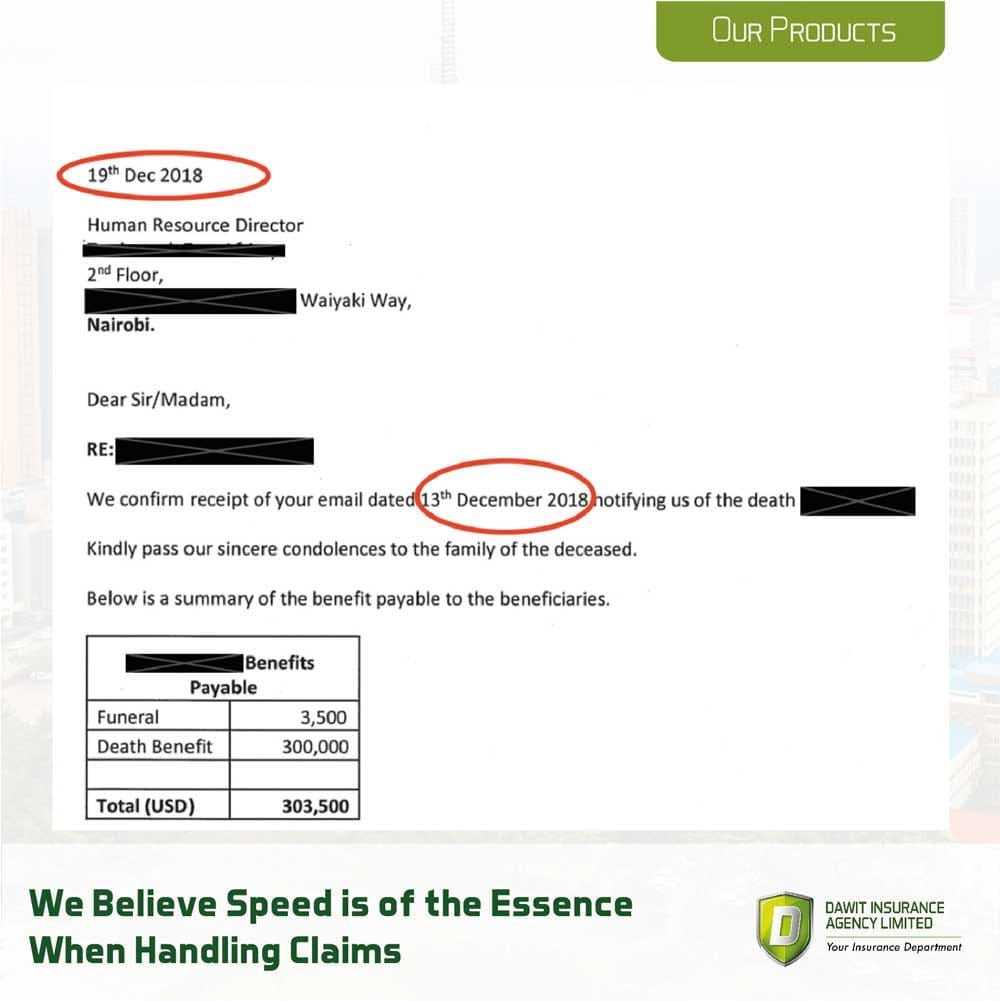

Life has some very unfortunate moments such as death. Death can be devastating for families both emotionally and financially. At Dawit, we pride ourselves in how we handle claims. We help our customers get genuine claims settled speedily and fairly. The image showcases an email conversation between a client and Dawit.

Claiming

Stress free medical insurance claims. What's your role and what's our role?

Dawit Insurance Agency

We at Dawit insurance specialize in guiding you through which product best suits your needs. We will source quotations from different providers on your behalf and comprehensively analyze the offer to determine the one that has the best terms within your budget limit.

We also guide you through the claiming process, assist with seeking pre-authorisations, card replacements and advice on exclusions

Your Orginization

Health insurance has a relatively straightforward claims process. In most cases, all you need to do is present the issued insurance card at any hospital countrywide that accepts your cover. For inpatient services, meaning admission at the hospital, most insurance companies require you to notify them within the first 48 hours of admission.

Be assured you're in safe hands. We have over 15 years of experience in the industry having won a multitude of awards from various insurance companies.

Let's start the conversation

Your first steps towards covering your people or group with medical Insurance begins here. Regardless of the size of your business or group, we help you find a solution that meets your budget and needs.

Learn more about this product

Our ultimate interest is to match the customer’s expectations to the underwriter’s reality and eventually become our clients’ “insurance department”. This is achieved through a dedicated and professional staff and partnerships with insurance companies.

We’d love to hear from you about your business. As you continue to grow and take your business to the next level, let us worry about mitigating your risks. You can reach out by calling, emailing or paying us a visit. You can also fill in the form and we’ll get back to you in a bit.