The insurance industry in Kenya has experienced steady growth over the years despite the challenges such as a decline in economic growth and inflation, which have affected the purchasing power of would-be clients of the insurance companies. Inflation in Kenya in 2018 stood at 4.7% due to favorable rainfall patterns and stable food prices. Inflation rose slightly in 2019 as a result of unfavorable rainfall patterns and unstable food prices. Estimates indicate that the insurance industry grew by about 6% in the year 2018. There are about 52 industry players in the insurance sector, serving a population that’s mainly concentrated in urban areas. Nairobi has the largest population of consumers of the industry, with about 65% of insured parties living in the capital city.

Anyone who owns a car in Kenya is required by the law to get Third-party motor insurance at the least. There are two main types of motor insurance preferred by motor vehicle owners in Kenya, namely: comprehensive car insurance and third-party motor insurance. It’s estimated that Kenya imports slightly under 100,000 motor vehicles from second-hand markets such as Japan and Europe, which are either private or commercial motor vehicles. The entry of hailing applications in Kenya, such as Uber and Bolt, has increased the demand for motor vehicle insurance in Kenya as vehicle owners seek compliance. The urgent and growing demand for motor insurance has made it a lucrative mine for criminal entities. Fraudulent activities related to motor insurance remains one of the biggest headaches for insurance companies.

Fraud in the insurance industry

Reports indicate that 25% of insurance claims are fraudulent. According to the Association of Kenya Insurance, large losses amounting to hundreds of millions have been incurred by insurance companies offering motor insurance. Fraud related to motor insurance only competes with fraud related to health insurance in terms of prevalence. In 2017, insurance companies lost 2.74 billion as a result of fraudulent activities related to motor insurance. Only nine companies that provide motor insurance made a profit in this segment of their business, making it difficult for industry players to realize the sustainability of this segment. The syndicate involved motor vehicle owners, garage owners, spare part dealers, insiders in the insurance industry, and the police at times. Reports of fraud range from fake and staged robberies to malicious crashing of vehicles, which ultimately results in the filing of fraudulent insurance claims.

In addition to this, motor insurance providers have had to contend with cases of double insurance, fake insurance certificates, and stolen insurance certificates. Research carried out by Bismart showed that 12% of insurance policies do not exist in the underwriters’ databases even though the motor vehicle owners have paid for their premiums. 22% of the motor vehicle insurance policies surveyed cannot be validated. A report released by the Association of Kenya Insurance (AKI) recently showed that the cost of motor vehicle insurance fraud ranges between 8% and 10% of total costs paid for damage to property, losses, and health care insurance.

A way forward: Digital Motor Vehicle Insurance Certificate

It is against this background that the Association of Kenya Insurers recently unveiled the virtual form of the motor insurance certificate. The insurance sector is accused of being slow to embrace technology, given that other sectors such as the finance and agricultural sectors in Kenya have significantly incorporated the use of digital tools in their service delivery. The digital motor vehicle insurance certificate is expected to seal loopholes that have been exploited by fraudsters for years.

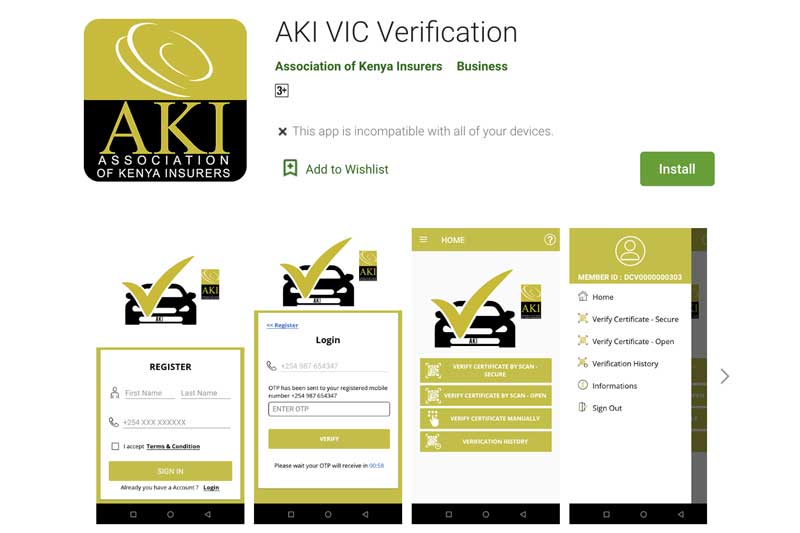

Unlike in the past, where motor vehicle insurance owners would get a certificate delivered to them, digitization will enable them to get their insurance certificate via their emails. Using the AKI application, which is available for download, or USSD code *352#, the insured can verify the status of their policy in real-time. It is estimated that over 50% of Kenyans own a smartphone; hence the digitization opens up a world of possibilities for the insured and insurance companies.

The process of motor vehicle certificate digitization began in 2019 with motorcycle insurance certificates. The second phase, which encompasses all other motor classes, started in January 2020. Reports by AKI indicate that since the roll of out of digitization, the industry players have saved over KShs. 40 million. Industry savings are expected to increase as the rollout continues. The physical certificate remains valid, where the insurer had not issued the new digital certificate. The association hopes to have phased out the physical certificate by mid-2020. The details on the digital motor insurance certificate remain the same as the details on the physical certificate that is being phased out. See a video clip from AKI explaining the changes.

Key features of the digital motor insurance certificate

There are distinguishing features in the new virtual certificate. In the past, the categories that would be displayed in the insurance certificates were commercial, PSV (public service), private vehicle, and motorcycle. It is important that the risk class selected matches the registration as per the logbook, as well as the actual usage of the vehicle. Otherwise, should the insured to apply for one insurance category and then use the vehicle for other purposes, the insured is vulnerable in the event of an incident or accident. Law enforcers will be able to verify whether a certificate is genuine or not in less than two minutes, unlike in the past when verification would take days.

Benefits of the digital motor insurance certificate

- It enhances traceability of the motor vehicle insurance certificate

- Helps curb fraud by ensuring that only one motor vehicle insurance certificate is issued per vehicle

- There is no need to worry about the loss of motor insurance certificate because you can always print another copy

- One can query the status of their motor vehicle insurance through AKI application which can be downloaded to one’s phone

- Provides real-time validation, just dial *352#

Requirements for getting a digital motor vehicle insurance certificate

- Copy of national identity card

- Copy of KRA PIN certificate

- Copy of vehicle’s logbook

- Copy of completed proposal form for the respective insurance provider

For business entities that get their motor vehicle insurance through an agent, the AKI application is available to agents who’ve been vetted and approved by the respective insurance underwriters.

Let us help you and your business navigate the changing landscape of motor insurance. Talk to us today